Table of Contents

Initial Prompt

An application to support a marketplace that allows businesses to fundraise from micro-investors via crowdfunding. Users register and can become business owners and/or investors. Users can set up a user profile.

Users can also create a business and its profile.

Users can launch a fundraising campaign for their business.

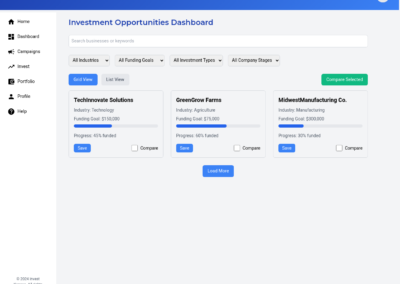

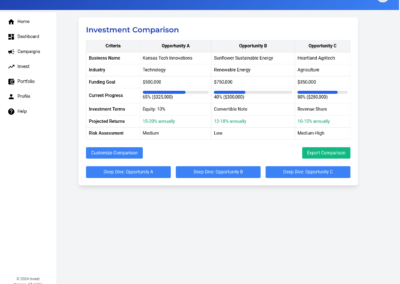

Users can also review other users’ campaigns/businesses for potential investment.

The fundraising campaigns will allow for configuration of the fundraising parameters such as the amount of the raise, type of asset offered, minimum/maximum investment amounts, etc.

Users can also invite other principles of their business to join and set up their profile.

As a business owner, I can have multiple businesses and multiple campaigns; I can also invest in other businesses’ campaigns.

As a user, I can invest in multiple campaigns for multiple businesses.

This application is for Kansas-based businesses and investors only.

Collected funds will be held in escrow at a federally sponsored banking institution, until escrow criteria is met and funds are distributed to the business.

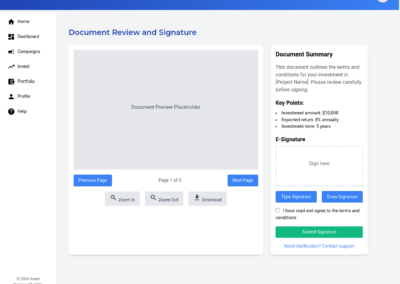

The application will require e-signature requirements.

The marketplace generates revenue by charging a percentage of monies invested. There might exist a business/fundraising campaign fundraising fee.

Everything beyond this point is generated by PrairieCode.AI in response to the above prompt.

Overview

Description

An application to support a marketplace that allows businesses to fundraise from micro-investors via crowdfunding. Users register and can become business owners and/or investors. Users can set up a user profile.

Users can also create a business and its profile.

Users can launch a fundraising campaign for their business.

Users can also review other users’ campaigns/businesses for potential investment.

The fundraising campaigns will allow for configuration of the fundraising parameters such as the amount of the raise, type of asset offered, minimum/maximum investment amounts, etc.

Users can also invite other principles of their business to join and set up their profile.

As a business owner, I can have multiple businesses and multiple campaigns; I can also invest in other businesses’ campaigns.

As a user, I can invest in multiple campaigns for multiple businesses.

This application is for Kansas-based businesses and investors only.

Collected funds will be held in escrow at a federally sponsored banking institution, until escrow criteria is met and funds are distributed to the business.

The application will require e-signature requirements.

The marketplace generates revenue by charging a percentage of monies invested. There might exist a business/fundraising campaign fundraising fee.

Problem Statement

Kansas-based businesses face significant challenges in securing funding from traditional sources, hindering their growth potential. The existing options for accessing capital are often inaccessible due to stringent requirements, lengthy processes, and high fees. This lack of readily available funding limits the ability of these businesses to expand, innovate, and contribute to the state’s economic development. Additionally, micro-investors in Kansas are seeking avenues to invest in local ventures but lack access to a platform that facilitates such investments, connecting them directly with businesses needing capital. This absence of a robust, locally focused crowdfunding platform creates a disconnect between these two groups, hindering investment opportunities and potentially hindering the growth of promising businesses.

Challenges

- Businesses in Kansas struggle to access funding due to limited traditional options, stringent requirements, lengthy processes, and high fees.

- Micro-investors in Kansas lack a platform to invest in local businesses, resulting in missed opportunities to support regional economic development.

- The absence of a dedicated, secure, and user-friendly platform creates a disconnect between businesses seeking funding and micro-investors willing to provide it.

- The lack of a streamlined and transparent process for facilitating investment transactions hinders the growth and development of Kansas businesses.

Alternative Solutions

KickstarterNot specific to Kansas-based businessesFocuses on creative projects rather than traditional businessesLacks features for ongoing investor relationshipsNo escrow services or e-signature capabilities

GoFundMePrimarily designed for personal fundraising, not business investmentsLacks features for equity offerings or investment returnsNo specific focus on Kansas-based businesses or investorsLimited business profile and campaign customization options

AngelListCaters to high-growth startups, not traditional small businessesMinimum investment amounts may be too high for micro-investorsNo specific focus on Kansas-based businessesComplex for novice investors or small business owners

WefunderNot tailored specifically for Kansas-based businesses and investorsMay have higher barriers to entry for small businessesLacks features for multiple business management within one accountLimited customization for local regulatory compliance

IndiegogoNot specific to Kansas-based businessesLacks features for ongoing investor relationshipsNo escrow services or e-signature capabilitiesMay have higher barriers to entry for small businesses

Significance

Addressing these challenges through the development of a comprehensive crowdfunding platform tailored specifically to Kansas businesses and investors would have a significant positive impact. By creating a platform that simplifies the investment process, reduces barriers to entry, and fosters trust between businesses and investors, it can empower local entrepreneurs, boost economic growth, and promote innovation within the state. Moreover, the platform can provide a valuable resource for micro-investors, offering them access to promising ventures and opportunities for financial returns while contributing to the development of their community. This solution would create a win-win scenario, fostering a vibrant and thriving entrepreneurial ecosystem in Kansas.

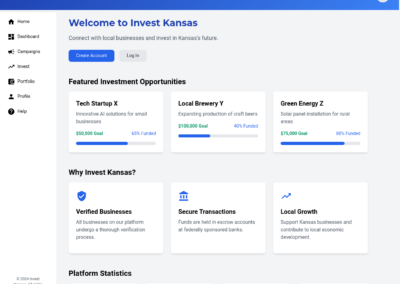

Solution Statement

We will develop a comprehensive, user-friendly crowdfunding platform specifically designed for Kansas-based businesses and investors. The platform will feature user profiles for both businesses and investors, enabling them to connect and interact effectively. Businesses will be able to launch fundraising campaigns with customizable parameters, including investment amounts, asset types, and fundraising goals. Investors will be able to review business profiles and campaigns, making informed investment decisions. The platform will ensure secure transactions through a dedicated escrow account held at a federally sponsored banking institution, ensuring funds are disbursed only after all escrow criteria are met. The platform will incorporate e-signature capabilities, streamlining the investment process and ensuring legal compliance. We will also implement a robust verification process for all users and businesses, ensuring the platform’s credibility and reliability. This platform will address the challenges Kansas businesses face in accessing funding from traditional sources, providing a streamlined and secure pathway for micro-investors to invest in promising local ventures. The solution will also provide AI-based investment recommendations.

KPIs

- Percentage increase in successful fundraising campaigns

- Reduction in time taken to match investors with suitable opportunities

- Enhanced user engagement and satisfaction metrics

Expected Benefits

- Increased access to capital for Kansas-based businesses, enabling growth and innovation opportunities that were previously limited by traditional funding sources

- Enhanced investment opportunities for Kansas-based micro-investors, allowing them to support local businesses and potentially earn returns

- Streamlined fundraising process for businesses, reducing the time and effort required to secure funding compared to traditional methods

- Improved transparency and security in the fundraising process through the use of escrow accounts and e-signature requirements

- Facilitation of direct connections between businesses and investors, fostering a stronger local business ecosystem in Kansas

- Customizable fundraising campaigns that allow businesses to tailor their offerings to their specific needs and investor preferences

- Reduced barriers to entry for both businesses seeking funding and individuals looking to invest in local ventures

- Potential for increased economic development in Kansas through the growth and success of locally funded businesses

- Enhanced decision-making for investors through access to comprehensive business profiles and AI-based investment recommendations

- Creation of a centralized marketplace for Kansas-based business funding, making it easier for investors to discover and evaluate investment opportunities

Application Classification

Digital Marketplace

Commercialization Model

Marketplace

Design Considerations

- Trust & Transparency: The platform must prioritize building trust with both businesses and investors by clearly displaying information about the verification process, escrow system, and legal compliance. This includes visual indicators of verified businesses and accounts, transparent transaction histories, and readily accessible legal documents.

- Localized Experience: The design should reflect the unique context of Kansas businesses and investors. Employ visual elements and language that resonate with the local audience, showcasing success stories of Kansas businesses and emphasizing the benefits of supporting local ventures.

- Intuitive Investment Journey: The investment process should be intuitive and streamlined for both businesses and investors. The platform should provide clear and concise information on investment opportunities, offer easy-to-understand campaign details, and facilitate seamless transaction processes.

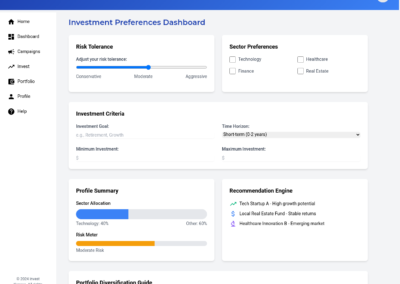

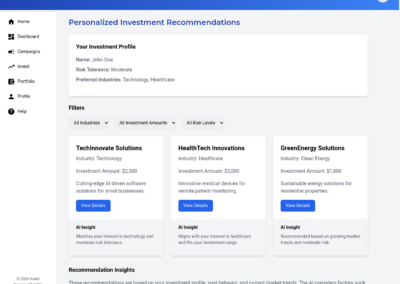

- Personalized AI Guidance: The AI-powered investment recommendations should be presented in a clear, actionable manner. Provide visually compelling insights into potential investments, highlighting key factors like risk, return, and alignment with user profiles. Integrate personalized recommendations throughout the platform to guide users towards relevant opportunities.

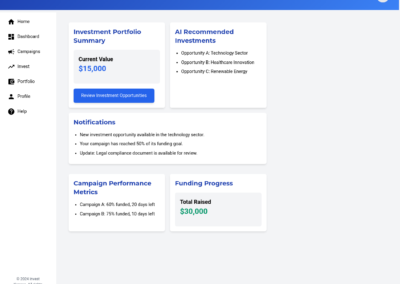

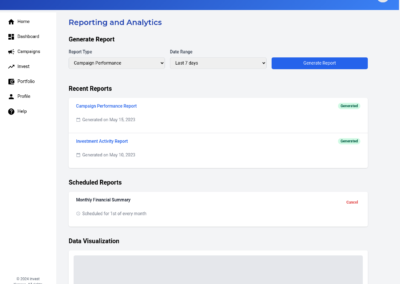

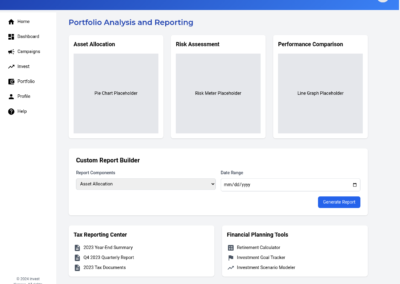

- Data-Driven Insights & Reporting: Offer comprehensive data visualization tools for both businesses and investors. Provide clear dashboards, reports, and charts that illustrate campaign performance, portfolio growth, and overall market trends. This empowers users to make informed decisions and track their progress.

User Types

Business Owner

Description

A user who creates and manages a business profile. They can launch fundraising campaigns, invite other business principles, and invest in other businesses’ campaigns.

Software Proficiency

LOW

Device Usages

- Desktop

- Phone

- Tablet

Needs

- Efficient campaign creation: Business owners need a streamlined process to set up and launch fundraising campaigns quickly, with customizable parameters for investment amounts, asset types, and goals.

- Investor connection: A mechanism to effectively connect with potential investors, showcasing business profiles and campaigns to attract funding.

- Secure fund management: A reliable system to handle financial transactions securely, ensuring that funds are properly managed and disbursed only when all criteria are met.

- Legal compliance: An integrated solution for managing legal requirements, including e-signatures and necessary documentation, to simplify the investment process and ensure regulatory adherence.

- Business growth insights: Access to AI-based investment recommendations and analytics to make informed decisions about their own business growth and potential investments in other ventures.

Pain Points

- Limited access to capital: Difficulty in securing funding from traditional sources, hindering business growth and expansion opportunities.

- Complex fundraising process: Time-consuming and often confusing procedures for setting up fundraising campaigns, leading to delays and missed opportunities.

- Investor trust and credibility: Challenges in establishing credibility and trust with potential investors, particularly for new or small businesses.

- Regulatory compliance burden: Struggle with navigating complex legal requirements and paperwork associated with fundraising and investments.

- Lack of investment guidance: Difficulty in identifying suitable investment opportunities in other businesses, potentially leading to poor investment decisions or missed growth opportunities.

Use Cases

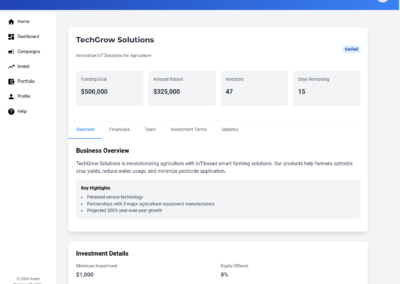

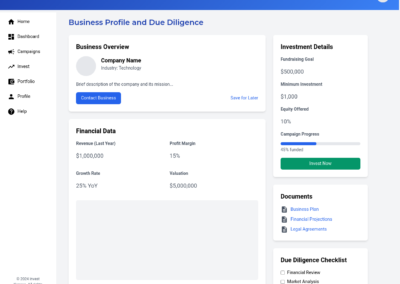

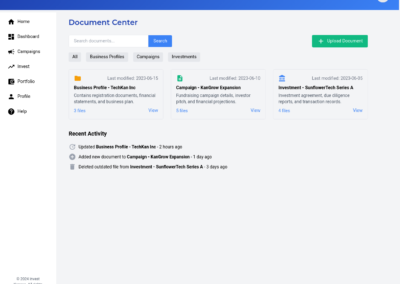

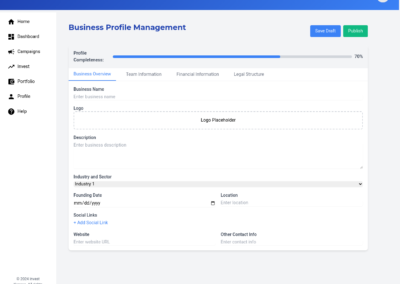

- Create Business Profile: Set up a detailed profile for the business, including company information, financial data, and growth plans.

These are the required inputs for a Business Profile:

- Business Overview: -Business Name -Logo -Featured Image / Hero -Description –Industry and sector –Description of products or services offered –Revenue generation strategy –Target market and customer demographics -Mission/Vision statement -Founding date -Location -Social links -Website -Other contact info?

- Team Information (trigger invite to team members): -Key team members –Name –Email –Role

- Financial Information: -Current financial status –revenue –expenses –margins -Previous funding rounds and amounts raised -Financial projections for the next 3-5 years

- Legal Structure: -Type of business entity (LLC, Corporation, etc.) -Relevant licenses and permits

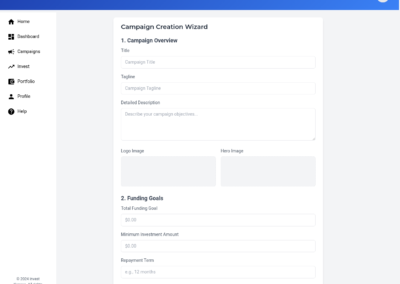

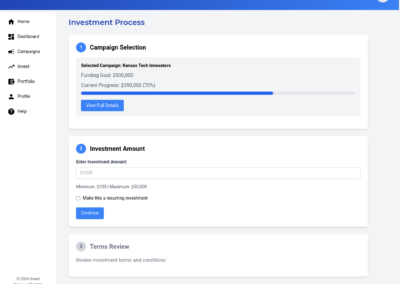

- Launch Fundraising Campaign: Initiate a new fundraising campaign by setting parameters such as fundraising goal, investment types, and minimum/maximum investment amounts.

These are the required inputs for a Campaign:

- Campaign Overview: -title -Tagline -Detailed description of the campaign objectives -Logo image -Hero image

- Funding Goals: -Total funding goal -Minimum investment amount -Repayment Term -Interest Rate/Return Rate

- Files/Documents -Business Plan -Pitch Deck -Financial Documents -Marketing Video -Image Gallery

- Market Analysis: -Competitors and competitive landscape -Market trends and opportunities

- Invite Business Principles: Add other key team members to the business profile, allowing them to contribute and manage the campaign.

- Monitor Campaign Progress: Track the fundraising campaign’s performance, including funds raised, investor interest, and time remaining.

- Post Updates: Be able to post updates to the fundraising campaign page for investors to view.

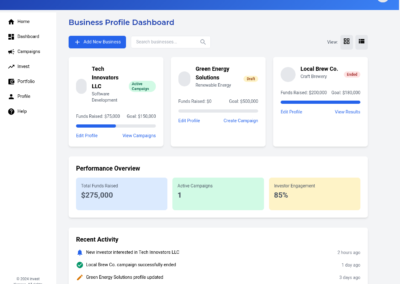

- Manage Multiple Businesses: Create and oversee multiple business profiles and their respective fundraising campaigns within a single account.

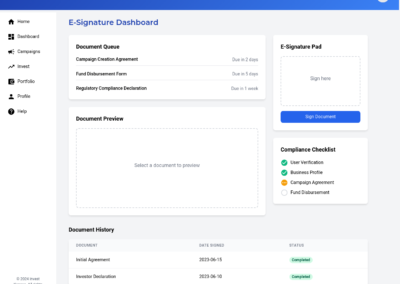

- Complete E-Signature Process: Electronically sign necessary documents for campaign creation, fund disbursement, and regulatory compliance.

Investor

Description

A user who invests in businesses’ fundraising campaigns. They can review businesses and campaigns, make investment decisions, and track their portfolio.

Software Proficiency

LOW

Device Usages

- Desktop

- Phone

- Tablet

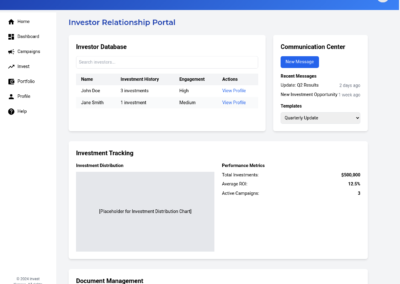

Needs

- Efficient business discovery. Investors need a streamlined way to find and evaluate Kansas-based businesses seeking funding. This includes access to comprehensive business profiles, financial data, and growth projections to make informed investment decisions.

- Secure investment process. A reliable and secure method for making investments, including features like e-signatures and escrow services. This ensures that funds are protected and only released when all conditions are met, reducing the risk of fraud or misuse of funds.

- Portfolio management tools. Investors require robust tools to track and manage their investments across multiple businesses. This includes features for monitoring performance, receiving updates, and analyzing the overall health of their investment portfolio.

- Personalized investment recommendations. AI-driven suggestions tailored to the investor’s preferences, risk tolerance, and investment history. This helps investors discover opportunities that align with their investment strategy and goals.

- Community engagement features. Tools for interacting with other investors and business owners, such as discussion forums or messaging systems. This facilitates knowledge sharing, due diligence, and potential co-investment opportunities.

Pain Points

- Limited access to local investment opportunities. Investors struggle to find and evaluate Kansas-based businesses seeking funding, often missing out on potentially lucrative local investments due to lack of visibility or connections.

- Complex and time-consuming investment processes. Traditional investment methods often involve lengthy paperwork, multiple intermediaries, and slow transaction times, deterring potential investors from participating in smaller or local ventures.

- Lack of transparency in business performance. Investors face difficulties in obtaining timely and accurate information about the businesses they’ve invested in, leading to uncertainty and potential missed opportunities for further investment or divestment.

- Inefficient portfolio diversification. Without tailored recommendations or easy access to a variety of local opportunities, investors struggle to effectively diversify their portfolios across different sectors and risk levels within the Kansas business ecosystem.

- Isolation in investment decision-making. Investors often lack platforms for connecting with other investors or experts in the Kansas business community, leading to limited perspectives and potentially overlooking valuable insights or co-investment opportunities.

Use Cases

- Browse investment opportunities: Investor searches and filters through available Kansas-based businesses and their fundraising campaigns.

- Review business profiles: Investor examines detailed information about businesses, including financial data and growth projections.

- Make investment: Investor selects a campaign, specifies investment amount, and completes the transaction using e-signature and secure payment.

- Track portfolio history and performance: Investor monitors the history of investments, their status and returns of their investments across multiple businesses.

- Receive personalized recommendations: Investor gets AI-driven suggestions for potential investments based on their preferences and history.

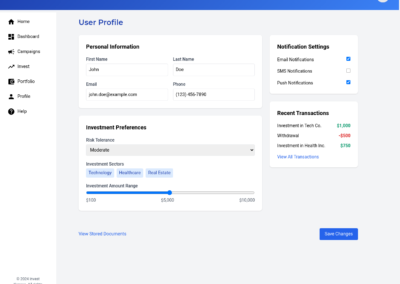

- Set investment preferences: Investor configures their risk tolerance, preferred sectors, and investment criteria for tailored recommendations.

System Administrator

Description

A user responsible for managing system settings and user accounts. This user also manages the investment transactions and related escrow for businesses and investors.

Software Proficiency

LOW

Device Usages

- Desktop

Needs

- Efficient user account management system: A streamlined interface for creating, modifying, and deactivating user accounts for businesses and investors. This would include tools for bulk operations and automated account verification processes.

- Robust transaction monitoring tools: Advanced features to oversee and manage investment transactions, including real-time tracking, automated flagging of suspicious activities, and detailed transaction history logs.

- Customizable escrow management system: Flexible tools to set up, monitor, and manage escrow accounts for various investment types and amounts. This should include automated disbursement based on predefined criteria and integration with the banking system.

- Comprehensive reporting and analytics dashboard: A centralized platform for generating and analyzing system-wide reports on user activities, transaction volumes, and platform performance metrics to inform decision-making and identify areas for improvement.

Pain Points

- Manual verification bottlenecks: The current process of manually verifying user and business credentials is time-consuming and prone to errors, leading to delays in account approvals and potential security risks.

- Limited visibility into transaction flows: Lack of real-time tracking and monitoring capabilities for investment transactions makes it difficult to identify and resolve issues promptly, potentially compromising the platform’s reliability.

- Inflexible escrow management: The inability to easily customize escrow terms and conditions for different types of investments leads to inefficiencies and potential legal complications in fund management and disbursement.

- Inadequate reporting capabilities: The absence of comprehensive, easy-to-use reporting tools hinders the ability to gain insights into platform performance and user behavior, making it challenging to make data-driven decisions for system improvements.

Use Cases

- Manage User Accounts: Create, modify, and deactivate user accounts for businesses and investors, including bulk operations and automated verification processes.

- Monitor Transactions: Oversee investment transactions with real-time tracking, automated flagging of suspicious activities, and detailed transaction history logs.

- Administer Escrow Accounts: Approve process for escrow account transactions.

- Generate Reports: Create and analyze system-wide reports on user activities, transaction volumes, and platform performance metrics.

- Configure System Settings: Adjust platform parameters, security settings, and integration configurations with banking systems and other third-party services.

- Manage Platform Fees: Set up, adjust, and monitor fee structures for fundraising campaigns and investment transactions.

Guest

Description

An unauthenticated user who can view open campaigns and business owner profiles for potential investment.

Software Proficiency

LOW

Device Usages

- Desktop

- Phone

- Tablet

Needs

- Easy access to investment opportunities. Guests need a simple way to browse and explore potential investment options without the barrier of registration. This allows them to gauge the platform’s offerings before committing to sign up.

- Transparent business information. Guests require clear, comprehensive profiles of businesses seeking funding, including financial data, business plans, and growth projections. This information helps them make informed decisions about potential investments.

- User-friendly interface. Given their low software proficiency, guests need an intuitive, easy-to-navigate platform that works seamlessly across desktop, phone, and tablet devices. This ensures they can effectively explore the platform regardless of their technical skills.

- Educational resources. Guests need access to educational content about crowdfunding, investment strategies, and risk assessment. This helps them understand the investment process and make more informed decisions about participating in the platform.

Pain Points

- Limited information access. Guests may feel frustrated by restricted access to detailed campaign information or investor-only features, hindering their ability to fully evaluate investment opportunities before registering.

- Uncertainty about platform legitimacy. Without a registered account, guests may struggle to verify the credibility of the platform and listed businesses, leading to hesitation in proceeding with registration or investment.

- Overwhelming complexity. The low software proficiency of guests can make navigating a feature-rich investment platform daunting, potentially deterring them from further engagement or registration.

- Lack of personalized recommendations. Without a user profile, guests cannot receive tailored investment suggestions, making it challenging to find opportunities that align with their interests and investment capacity.

Use Cases

- Browse investment opportunities: View a list of open fundraising campaigns and business profiles without authentication

- View business details: Access comprehensive information about a specific business, including financial data and growth projections

- Explore campaign specifics: Review detailed information about a fundraising campaign, including investment parameters and goals

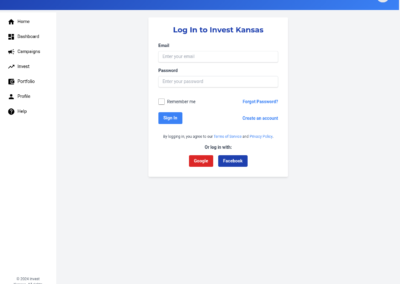

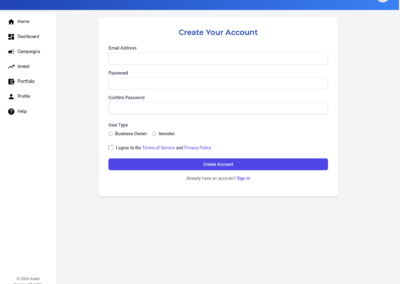

- Register for an account: Create a new user account to gain full access to the platform’s features

Advanced Considerations

Security Requirements

User Authentication and Authorization

Description

To ensure secure access to user accounts, protect sensitive financial information, and maintain the integrity of fundraising campaigns and investment activities.

Rationale

Implement a robust user authentication system with multi-factor authentication and role-based access control for business owners, investors, and platform administrators.

Secure Data Transmission

Description

To protect sensitive user data and financial information from interception or tampering during transmission, maintaining the confidentiality and integrity of all platform communications.

Rationale

Use TLS 1.3 or higher for all data transmissions between clients and servers, including user information, financial transactions, and campaign details.

E-Signature Integration

Description

To ensure legal compliance and non-repudiation for all investment agreements and transactions conducted through the platform.

Rationale

Implement a secure e-signature system compliant with the ESIGN Act, integrated directly into the platform’s investment process.

Secure Fund Management

Description

To protect the integrity of financial transactions, prevent unauthorized access to funds, and ensure secure transfer of funds between investors, the platform, and businesses.

Rationale

Implement end-to-end encryption for all financial transactions and integrate with the escrow system using secure APIs and strong authentication mechanisms.

Data Encryption at Rest

Description

To protect user and business data from unauthorized access in case of a data breach or physical access to storage systems.

Rationale

Encrypt all sensitive data at rest, including user profiles, business information, and transaction records, using industry-standard encryption algorithms such as AES-256.

Compliance Requirements

Securities Act Compliance for Crowdfunding Platform

Description

Compliance requirements for a Kansas-based crowdfunding platform under the Securities Act of 1933, focusing on registration, disclosure, and investor protection.

Framework

Securities Act of 1933

Rationale

The crowdfunding platform facilitates the offering of securities to investors, which is regulated by the Securities Act of 1933. Compliance is necessary to ensure proper registration or exemption, adequate disclosure, and investor protection.

Specific Requirements

Register the offering or qualify for an exemption

Reference Section 5 of the Securities Act of 1933

Quote Unless a registration statement is in effect as to a security, it shall be unlawful for any person, directly or indirectly […] to make use of any means or instruments of transportation or communication in interstate commerce or of the mails to sell such security through the use or medium of any prospectus or otherwise.

Provide comprehensive disclosure to potential investors

Reference Section 7 of the Securities Act of 1933

Quote The registration statement […] shall contain such other information, and be accompanied by such other documents, as the Commission may by rules or regulations require as being necessary or appropriate in the public interest or for the protection of investors.

Implement measures to prevent fraud

Reference Section 17 of the Securities Act of 1933

Quote It shall be unlawful for any person in the offer or sale of any securities […] to obtain money or property by means of any untrue statement of a material fact or any omission to state a material fact necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading.

Ensure compliance with intrastate offering requirements

Reference Section 3(a)(11) of the Securities Act of 1933

Quote Any security which is a part of an issue offered and sold only to persons resident within a single State or Territory, where the issuer of such security is a person resident and doing business within or, if a corporation, incorporated by and doing business within, such State or Territory.

Implement investor limits and issuer caps if relying on crowdfunding exemption

Reference Section 4(a)(6) of the Securities Act of 1933

Quote The aggregate amount sold to all investors by the issuer […] does not exceed $1,000,000 […] The aggregate amount sold to any investor by an issuer […] does not exceed […] the greater of $2,000 or 5 percent of the annual income or net worth of such investor, as applicable, if either the annual income or the net worth of the investor is less than $100,000.

JOBS Act Crowdfunding Compliance

Description

Compliance requirements for the crowdfunding platform under the Jumpstart Our Business Startups (JOBS) Act

Framework

Jumpstart Our Business Startups (JOBS) Act

Rationale

The application functions as a crowdfunding platform, which falls under the regulatory scope of the JOBS Act. Compliance with these requirements is essential to operate legally and protect both issuers and investors.

Specific Requirements

Implement fundraising limits for issuers

Reference Securities Act Section 4(a)(6)

Quote The aggregate amount sold to all investors by the issuer… is not more than $1,070,000

Enforce investment limits for investors

Reference Securities Act Section 4(a)(6)

Quote The aggregate amount sold to any investor… does not exceed… the greater of $2,200 or 5 percent of the lesser of the investor’s annual income or net worth

Provide necessary disclosures for offerings

Reference Securities Act Section 4A(b)

Quote An issuer… shall file with the Commission and provide to investors… the information required under subsection (b)

Conduct transactions through a registered intermediary

Reference Securities Act Section 4A(a)

Quote The transaction is conducted through a broker or funding portal that complies with the requirements of section 4A(a)

Implement measures to reduce fraud risk

Reference Securities Act Section 4A(a)(5)

Quote The issuer and the offering comply with such other requirements as the Commission may, by rule, prescribe for the protection of investors and in the public interest

E-SIGN Act Compliance for Electronic Signatures

Description

Ensure that the application’s e-signature functionality complies with the Electronic Signatures in Global and National Commerce Act (E-SIGN Act) to maintain the legal validity and enforceability of electronic signatures used in the crowdfunding platform.

Framework

Electronic Signatures in Global and National Commerce Act (E-SIGN Act)

Rationale

The application requires e-signature capabilities for investment transactions and agreements. Compliance with the E-SIGN Act is necessary to ensure these electronic signatures are legally valid and enforceable, providing a secure and legally sound environment for businesses and investors to conduct transactions.

Specific Requirements

Obtain consumer consent for electronic records

Reference 15 U.S.C. § 7001(c)(1)(A)

Quote Notwithstanding subsection (a), if a statute, regulation, or other rule of law requires that information relating to a transaction or transactions in or affecting interstate or foreign commerce be provided or made available to a consumer in writing, the use of an electronic record to provide or make available (whichever is required) such information satisfies the requirement that such information be in writing if […] the consumer has affirmatively consented to such use and has not withdrawn such consent

Provide clear and conspicuous statement of rights

Reference 15 U.S.C. § 7001(c)(1)(B)(i)

Quote The consumer […] prior to consenting, is provided with a clear and conspicuous statement […] informing the consumer of (I) any right or option of the consumer to have the record provided or made available on paper or in nonelectronic form, and (II) the right of the consumer to withdraw the consent to have the record provided or made available in an electronic form and of any conditions, consequences (which may include termination of the parties’ relationship), or fees in the event of such withdrawal

Ensure consumer’s ability to access electronic records

Reference 15 U.S.C. § 7001(c)(1)(C)(ii)

Quote The consumer […] consents electronically, or confirms his or her consent electronically, in a manner that reasonably demonstrates that the consumer can access information in the electronic form that will be used to provide the information that is the subject of the consent

Maintain record retention and reproduction capabilities

Reference 15 U.S.C. § 7001(d)(1)

Quote If a statute, regulation, or other rule of law requires that a contract or other record relating to a transaction in or affecting interstate or foreign commerce be retained, that requirement is met by retaining an electronic record of the information in the contract or other record that […] accurately reflects the information set forth in the contract or other record; and […] remains accessible to all persons who are entitled to access by statute, regulation, or rule of law, for the period required by such statute, regulation, or rule of law, in a form that is capable of being accurately reproduced for later reference, whether by transmission, printing, or otherwise

Bank Secrecy Act (BSA) Compliance for Crowdfunding Platform

Description

Compliance requirements for a Kansas-based crowdfunding platform under the Bank Secrecy Act (BSA) framework, focusing on anti-money laundering (AML) and know your customer (KYC) procedures.

Framework

Bank Secrecy Act (BSA)

Rationale

The crowdfunding platform facilitates financial transactions and fund transfers between businesses and investors, necessitating compliance with BSA requirements to prevent money laundering and ensure proper customer identification.

Specific Requirements

Implement a Customer Identification Program (CIP)

Reference 31 CFR § 1020.220

Quote A bank must implement a written Customer Identification Program (CIP) appropriate for its size and type of business that, at a minimum, includes each of the requirements of paragraphs (a)(1) through (5) of this section.

Establish a Customer Due Diligence (CDD) program

Reference 31 CFR § 1010.210

Quote A financial institution shall establish and maintain written policies, procedures, and internal controls reasonably designed to achieve compliance with the Bank Secrecy Act and the requirements of this chapter.

Implement Suspicious Activity Reporting (SAR)

Reference 31 CFR § 1020.320

Quote Every bank shall file with the Treasury Department, to the extent and in the manner required by this section, a report of any suspicious transaction relevant to a possible violation of law or regulation.

Maintain records of financial transactions

Reference 31 CFR § 1010.410

Quote Each financial institution shall retain either the original or a microfilm or other copy or reproduction of each of the following: (a) A record of each extension of credit in an amount in excess of $10,000…

Implement a risk-based approach to AML compliance

Reference FinCEN Guidance FIN-2014-A007

Quote Financial institutions should apply a risk-based approach to BSA/AML compliance, focusing their resources on areas of greatest risk.

Accessibility Requirements

Keyboard Accessibility

Description

Users who are unable to use a mouse due to physical disabilities rely on keyboard navigation to interact with the application.

Rationale

Ensure all interactive elements are operable through a keyboard interface. (WCAG 2.1 Level A – 2.1.1 Keyboard)

Screen Reader Compatibility

Description

Users with visual impairments depend on screen readers to understand and navigate the application, requiring proper semantic markup.

Rationale

Implement ARIA roles and labels to ensure compatibility with screen readers. (WCAG 2.1 Level A – 1.3.1 Info and Relationships)

Color Contrast

Description

Adequate color contrast is essential for users with visual impairments, including color blindness, to read text and interact with elements.

Rationale

Ensure text and interactive elements have a contrast ratio of at least 4.5:1 against their background. (WCAG 2.1 Level AA – 1.4.3 Contrast (Minimum))

Text Resizing

Description

Users with low vision may need to enlarge text to read it comfortably, so the application should maintain usability at larger text sizes.

Rationale

Allow text to be resized up to 200% without loss of content or functionality. (WCAG 2.1 Level AA – 1.4.4 Resize Text)

Error Identification and Suggestions

Description

Users with cognitive disabilities benefit from clear instructions and suggestions to correct input errors, improving form usability and reducing frustration.

Rationale

Provide clear error identification and suggestions for correction. (WCAG 2.1 Level AA – 3.3.3 Error Suggestion)

Performance Requirements

Page Load Time

Description

Fast page load times are crucial for user engagement and satisfaction, especially for a platform where users will be reviewing multiple business profiles and campaigns.

Rationale

Ensure 90% of web pages load within 3 seconds or less for users with standard broadband connections.

Transaction Processing Time

Description

Quick transaction processing is essential to maintain investor confidence and ensure a smooth user experience during the critical moment of investment.

Rationale

Process 95% of investment transactions within 5 seconds from initiation to confirmation.

Concurrent User Support

Description

As a Kansas-focused platform, it needs to handle a moderate number of simultaneous users to ensure accessibility during high-traffic periods or popular campaigns.

Rationale

Support at least 1,000 concurrent users during peak hours without degradation in performance.

API Response Time

Description

Rapid API responses are crucial for maintaining a responsive user interface and providing timely investment recommendations, enhancing the overall user experience.

Rationale

Ensure 95% of API calls, including AI-based investment recommendations, respond within 500 milliseconds.

Data Retrieval Speed

Description

Quick access to business and campaign information is vital for investors to make informed decisions efficiently, improving the platform’s usability and effectiveness.

Rationale

Retrieve and display business profiles and campaign details within 2 seconds for 90% of requests.

Accessibility Requirements

Keyboard Accessibility

Description

Users who are unable to use a mouse due to physical disabilities rely on keyboard navigation to interact with the application.

Rationale

Ensure all interactive elements are operable through a keyboard interface. (WCAG 2.1 Level A – 2.1.1 Keyboard)

Screen Reader Compatibility

Description

Users with visual impairments depend on screen readers to understand and navigate the application, requiring proper semantic markup.

Rationale

Implement ARIA roles and labels to ensure compatibility with screen readers. (WCAG 2.1 Level A – 1.3.1 Info and Relationships)

Color Contrast

Description

Adequate color contrast is essential for users with visual impairments, including color blindness, to read text and interact with elements.

Rationale

Ensure text and interactive elements have a contrast ratio of at least 4.5:1 against their background. (WCAG 2.1 Level AA – 1.4.3 Contrast (Minimum))

Text Resizing

Description

Users with low vision may need to enlarge text to read it comfortably, so the application should maintain usability at larger text sizes.

Rationale

Allow text to be resized up to 200% without loss of content or functionality. (WCAG 2.1 Level AA – 1.4.4 Resize Text)

Error Identification and Suggestions

Description

Users with cognitive disabilities benefit from clear instructions and suggestions to correct input errors, improving form usability and reducing frustration.

Rationale

Provide clear error identification and suggestions for correction. (WCAG 2.1 Level AA – 3.3.3 Error Suggestion)

Modules

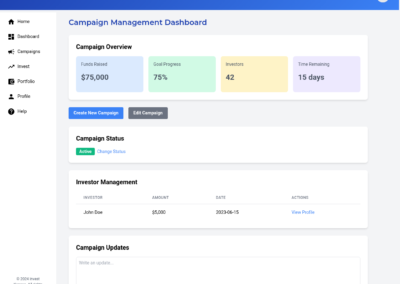

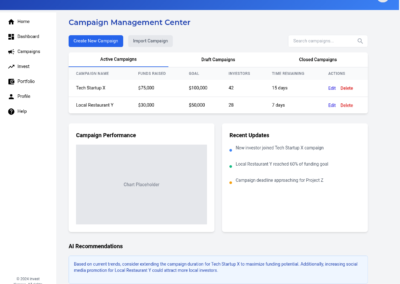

Campaign Management

Description

Business Owners can create, edit, and manage their fundraising campaigns. Users can set fundraising goals, define investment parameters, and track campaign performance. They can also manage campaign investors, respond to investor inquiries, and track payments. This module will contain a dashboard where users can view all their current campaigns, their campaign progress, and their campaign performance. It will also include sub-modules for creating new campaigns, editing campaign details, and managing investors.

Functional Design

- Campaign Creation InterfaceThe Campaign Creation Interface aims to provide business owners with an intuitive, step-by-step process for setting up fundraising campaigns. The interface will include a series of guided forms that prompt users to input essential campaign details, such as fundraising goals, investment parameters, and campaign duration. Form validation mechanisms will be implemented to ensure the accuracy and completeness of the information before submission. The interface will feature real-time validation feedback, allowing users to correct any errors promptly. Additionally, the interface will support the ability to save campaigns as drafts, enabling business owners to complete the setup over multiple sessions. A preview function will be available to review the campaign’s presentation before final submission. The system will also manage campaign statuses (DRAFT, LIVE, PAUSED, CLOSED) to help business owners monitor their campaign’s progress. The interface design will prioritize user experience, ensuring ease of navigation and accessibility for non-technical users, while maintaining compliance with regulatory data integrity requirements. This module will serve as a critical component of the crowdfunding platform, empowering Kansas-based businesses to effectively launch and manage their fundraising campaigns.Also, these are the required inputs for a Campaign:1. Campaign Overview:

-title

-Tagline

-Detailed description of the campaign objectives

-Logo image

-Hero image

2. Funding Goals:

-Total funding goal

-Minimum investment amount

-Repayment Term

-Interest Rate/Return Rate

3. Files/Documents

-Business Plan

-Pitch Deck

-Financial Documents

-Marketing Video

-Image Gallery

4. Market Analysis:

-Competitors and competitive landscape

-Market trends and opportunities- User Stories

- As a Business Owner, I want to access a user-friendly interface to create a new fundraising campaign, so that I can easily set up my campaign without technical difficulties.

- As a Business Owner, I want to be guided through a step-by-step process for inputting campaign details, so that I can ensure all necessary information is provided accurately.

- As a Business Owner, I want to set my fundraising goals within the campaign creation interface, so that potential investors clearly understand my financial targets.

- As a Business Owner, I want to define investment parameters for my campaign, so that I can attract the right type of investors for my business needs.

- As a Business Owner, I want to specify the duration of my fundraising campaign, so that investors know the timeframe for making investment decisions.

- As a Business Owner, I want the interface to validate my input in real-time, so that I can correct any errors before submitting the campaign for review.

- As a Business Owner, I want to save my campaign as a draft, so that I can complete the creation process over multiple sessions if needed.

- As a Business Owner, I want to preview my campaign before submission, so that I can ensure all information is presented correctly to potential investors.

- As a System Administrator, I want to ensure that all required fields are completed in the campaign creation form, so that we maintain data integrity and compliance with regulatory requirements.

- As an Investor, I want to easily view newly created campaigns, so that I can quickly identify new investment opportunities.

- As a Business Owner, I want to have the status of my campaign displayed as DRAFT, LIVE, PAUSED, or CLOSED, so that I can easily track the progress and current state of my fundraising campaign.

- User Stories

- Campaign Editing Functionality

The Campaign Editing Functionality module is designed to provide business owners with the ability to manage and update their fundraising campaigns seamlessly. This functionality is critical for maintaining accurate and relevant campaign information, which is essential for attracting and retaining investor interest. The module enables business owners to edit campaign details, including adjusting fundraising goals, modifying investment parameters, and updating campaign descriptions. To ensure data integrity and prevent accidental changes, a confirmation prompt is required for any critical updates. The system also logs all edits for compliance purposes and notifies investors of significant changes, allowing them to make informed decisions. User interface elements must facilitate intuitive navigation for editing campaigns, and robust validation mechanisms are essential to ensure data accuracy. This functionality supports the overall goal of the crowdfunding platform by providing a dynamic and responsive environment for businesses to present their investment opportunities effectively.

- User Stories

- As a Business Owner, I want to edit my existing campaign details so that I can keep my fundraising information up-to-date and accurate.

- As a Business Owner, I want to update my fundraising goals so that I can adjust my campaign targets based on current market conditions or business needs.

- As a Business Owner, I want to modify investment parameters so that I can refine the terms offered to potential investors as my campaign progresses.

- As a Business Owner, I want to revise my campaign description so that I can provide the most current and compelling information about my business to potential investors.

- As a Business Owner, I want to receive a confirmation prompt for critical changes so that I can prevent accidental modifications to important campaign information.

- As an Investor, I want to be notified of significant changes to campaigns I’m interested in so that I can reassess my investment decisions based on the most current information.

- As a System Administrator, I want to monitor and log all campaign edits so that I can ensure compliance with platform policies and maintain data integrity.

- User Stories

- Campaign Dashboard

The Campaign Dashboard module is designed to provide business owners with a comprehensive view of all their active fundraising campaigns. It aims to deliver key metrics such as the total funds raised, the percentage of fundraising goals achieved, the number of investors, and the time remaining for each campaign. To achieve this, the dashboard will utilize data visualization tools to present these metrics in an intuitive and easily digestible format, allowing business owners to quickly assess the performance of their campaigns. The dashboard will include interactive charts and graphs, such as bar charts for fund progress and pie charts for investor distribution, providing a clear overview of campaign status. Users will have the ability to customize the dashboard layout to focus on the metrics that are most important to them, such as reordering or resizing widgets and selecting different visualization styles. Additionally, the dashboard will support real-time data updating to ensure that users always have the most current information at their fingertips. For investors, the dashboard will offer a summary view of all campaigns they have invested in, highlighting their contributions and the campaigns’ progress. To ensure performance and security, the dashboard will optimize data loading to guarantee a loading time of less than 3 seconds for 90% of users and use TLS 1.3 or higher to secure data transmission. This module is crucial for enabling business owners to make informed decisions about their fundraising efforts and for maintaining investor confidence by providing transparent and up-to-date campaign information.- User Stories

- As a Business Owner, I want to view a comprehensive dashboard displaying all my current campaigns so that I can quickly assess their overall performance.

- As a Business Owner, I want to see key metrics such as funds raised, percentage of goal achieved, number of investors, and time remaining for each campaign so that I can make informed decisions about my fundraising efforts.

- As a Business Owner, I want access to data visualization tools that present campaign information in an easily digestible format so that I can quickly understand the status of my fundraising efforts.

- As a Business Owner, I want the ability to customize the dashboard layout to suit my preferences so that I can focus on the metrics most important to me.

- As an Investor, I want to view a summary of all active campaigns I’ve invested in so that I can track their progress and performance.

- As a System Administrator, I want to ensure that the dashboard loads within 3 seconds for 90% of users so that we maintain a high level of user satisfaction and engagement.

- As a System Administrator, I want to implement secure data transmission for all dashboard information using TLS 1.3 or higher so that we protect sensitive financial data during transmission.

- User Stories

- Investor Management System

The Investor Management System is designed to effectively manage and track campaign investors, ensuring a seamless interaction between business owners and investors on the crowdfunding platform. It will feature a centralized database to securely store investor information, including personal details and investment history. The system will implement robust data encryption at rest and in transit to protect sensitive data from unauthorized access. Access controls will be established to ensure that only authorized personnel can view or modify investor data. A secure API will facilitate confidential communications between investors and businesses, allowing business owners to respond to inquiries and provide updates efficiently. The system will enable business owners to view and analyze a list of all investors in their campaigns, tracking individual investments to monitor progress toward fundraising goals. Additionally, the platform will support posting updates on campaign pages, enhancing transparency and engagement. For investors, the system will offer a user-friendly interface to review their investment history and interactions with businesses, supporting informed decision-making. By integrating these features, the Investor Management System will uphold compliance with data protection regulations and enhance the platform’s credibility and reliability, providing a secure and efficient environment for investment activities.- User Stories

- As a Business Owner, I want to view a list of all investors in my campaign so that I can track who has invested in my business.

- As a Business Owner, I want to store and manage investor information securely so that I can maintain accurate records and comply with data protection regulations.

- As a Business Owner, I want to communicate with investors through the platform so that I can respond to inquiries and provide updates efficiently.

- As a Business Owner, I want to track individual investments in my campaign so that I can monitor the progress towards my fundraising goal.

- As a System Administrator, I want to implement robust data encryption for investor information at rest so that we can protect sensitive data from unauthorized access.

- As a System Administrator, I want to set up access controls for investor data so that only authorized personnel can view or modify this information.

- As a System Administrator, I want to implement a secure API for handling investor communications so that we can ensure the confidentiality of all platform communications.

- As an Investor, I want to view a history of my interactions with each business I’ve invested in so that I can keep track of our communications.

- User Stories

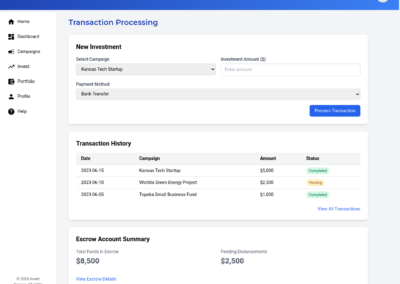

- Payment Tracking Module

The Payment Tracking Module is essential for managing and monitoring financial transactions associated with crowdfunding campaigns on the platform. It integrates seamlessly with the escrow system to ensure accurate tracking of fund disbursements. This module will include features such as automated notifications for successful payments, failed transactions, and upcoming disbursements, providing both business owners and investors with timely and relevant updates. It will store detailed transaction histories for each campaign, enabling easy financial reconciliation and auditing. Business owners will have the ability to view comprehensive transaction details and receive real-time alerts to manage their fundraising activities effectively. Investors will be able to track the status of their investments and payments, allowing them to monitor their portfolio’s progress. The system administrator will have capabilities to generate detailed transaction reports for oversight and compliance purposes, ensuring secure data transmission in line with BSA requirements. The module will also be optimized for performance, with 95% of API calls expected to respond within 500 milliseconds, ensuring a responsive user experience.- User Stories

- As a Business Owner, I want to view a detailed transaction history for each campaign so that I can easily reconcile and audit the financial activities.

- As a Business Owner, I want to receive automated notifications for successful payments so that I can stay informed about the progress of my fundraising campaign.

- As a Business Owner, I want to be alerted about failed transactions so that I can take prompt action to resolve any issues.

- As a Business Owner, I want to receive notifications about upcoming disbursements so that I can plan my business activities accordingly.

- As an Investor, I want to track the status of my investments and related payments so that I can monitor the progress of my portfolio.

- As a System Administrator, I want to integrate the payment tracking module with the escrow system so that I can ensure accurate monitoring of fund disbursements.

- As a System Administrator, I want to generate comprehensive transaction reports so that I can oversee the platform’s financial activities and ensure compliance.

- As a System Administrator, I want to implement secure data transmission for all payment-related information so that I can protect sensitive financial data in accordance with BSA requirements.

- As a System Administrator, I want to ensure that 95% of payment tracking API calls respond within 500 milliseconds so that I can maintain a responsive user experience.

- User Stories

- Campaign Lifecycle Management

The Campaign Lifecycle Management module is designed to streamline the entire process of managing fundraising campaigns from inception to closure. It includes robust status tracking capabilities, enabling campaigns to be marked as draft, active, paused, or closed. The module intelligently handles automated transitions between these states based on predefined timeframes or funding milestones, minimizing the need for manual intervention and ensuring smooth progression of campaigns. Post-campaign activities are also a critical aspect, with the module facilitating the generation of comprehensive final reports for investors, detailing the outcomes and financial summary of the campaign. The system is equipped with a workflow for closing campaigns that ensures all necessary steps are completed, including secure fund disbursement via the escrow system, in compliance with platform policies and regulations. Additionally, the module provides a dashboard view for business owners to track all their campaigns and their current lifecycle stages, as well as filtering options for investors to focus on campaigns that match their preferences. Notifications and alerts are integrated to keep business owners and investors informed of status changes, thereby enhancing decision-making and fostering proactive engagement. This module is integral to the platform’s functionality, ensuring campaigns are managed efficiently, transparently, and in accordance with legal and security standards.- User Stories

- As a Business Owner, I want to create a new fundraising campaign with customizable parameters so that I can effectively launch and manage my funding efforts.

- As a Business Owner, I want to set the status of my campaign (draft, active, paused, closed) so that I can control its visibility and progress.

- As a Business Owner, I want the system to automatically transition my campaign status based on time or funding milestones so that the campaign progresses without manual intervention.

- As an Investor, I want to view the current status of a campaign so that I can make informed decisions about potential investments.

- As a Business Owner, I want to generate a final report for investors upon campaign closure so that I can provide transparency about the fundraising results.

- As an Investor, I want to receive a final report when a campaign I’ve invested in closes so that I can review the outcomes of my investment.

- As a System Administrator, I want to configure automated status transitions for campaigns so that they progress through their lifecycle according to predefined rules.

- As a Business Owner, I want to initiate the fund disbursement process when my campaign closes successfully so that I can access the raised capital.

- As a System Administrator, I want to oversee the fund disbursement process for closed campaigns so that I can ensure compliance with platform policies and regulations.

- As a Business Owner, I want to view a dashboard of all my campaigns and their current lifecycle stages so that I can easily track their progress.

- As an Investor, I want to filter campaigns based on their lifecycle stage so that I can focus on opportunities that match my investment preferences.

- As a Business Owner, I want to be notified when my campaign status changes automatically so that I can take appropriate actions if needed.

- As an Investor, I want to be alerted when a campaign I’m interested in changes status so that I can make timely investment decisions.

- As a System Administrator, I want to ensure that fund disbursements are processed securely through the escrow system so that all transactions comply with financial regulations and platform policies.

- User Stories

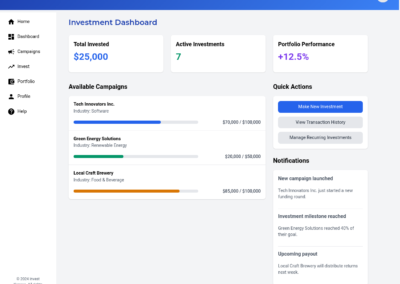

Investment Management

Description

Investors can search and view businesses and campaigns, make investment decisions, and manage their investment portfolio. Users can view campaign details, review business profiles, and make investment commitments. They can also track their investment performance, manage their investment portfolio, and receive updates on their investments. This module will contain a dashboard where users can view all their current investments, their investment performance, and their overall portfolio. It will also include sub-modules for searching campaigns and businesses, making investment decisions, and tracking investment performance.

Functional Design

- Investment Search and Filter

The Investment Search and Filter module is designed to provide investors with an efficient way to discover and evaluate investment opportunities on the crowdfunding platform. This module allows users to conduct searches based on business name, industry, location, and specific campaign parameters. Advanced filtering options enable users to refine their searches by specifying investment amount ranges and campaign durations, aligning with their investment strategies. The search results are displayed in a clear, sortable list format, highlighting key information such as campaign goals, business profiles, and investment returns to facilitate quick comparisons. The user interface is designed for ease of use, allowing both registered investors and guests to navigate and utilize the search functionalities effectively. Additionally, the system must ensure high performance, responding to search and filter requests within 2 seconds for 95% of queries. Security measures should be in place to protect user data during searches, and compliance with data privacy regulations is mandatory. The module also supports business owners by ensuring their campaigns are easily discoverable, thus enhancing visibility to potential investors.- User Stories

- As an Investor, I want to search for investment opportunities using specific criteria so that I can efficiently find relevant businesses to invest in.

- As an Investor, I want to filter search results by business name, industry, and location so that I can narrow down potential investments based on my preferences.

- As an Investor, I want to apply advanced filters such as investment amount range and campaign duration so that I can find opportunities that match my investment strategy.

- As an Investor, I want to view search results in a clear, sortable list with key information visible at a glance so that I can quickly compare multiple investment opportunities.

- As a Guest, I want to browse and filter open campaigns without authentication so that I can explore potential investment opportunities before registering.

- As a System Administrator, I want to ensure that the search and filter functionality responds within 2 seconds for 95% of requests so that users experience a responsive and efficient platform.

- As a Business Owner, I want my campaign to be discoverable through relevant search terms and filters so that I can attract potential investors more effectively.

- User Stories

- Business Profile Review

The Business Profile Review module will serve as a central interface for investors to access detailed business profiles, which are essential for making informed investment decisions. This module will standardize the presentation of key business information such as financial data, growth projections, team details, and historical performance metrics. Each business profile will be formatted consistently to facilitate easy comparison across different investment opportunities. The interface will support interactive elements, allowing investors to delve deeper into specific data points, view trends, and access summaries of key financial indicators. To ensure security and compliance, all sensitive data shall be encrypted both at rest and in transit, aligning with data protection regulations. The module will be optimized for performance, ensuring profiles load within 2 seconds to enhance user experience. Real-time updates will allow business owners to provide the most current data, while a guest view option will enable potential investors to explore profiles without needing to register initially. This comprehensive design will enhance the credibility and efficiency of the crowdfunding platform, providing a reliable tool for investors and businesses alike.- User Stories

- As an Investor, I want to view a comprehensive business profile that includes financial data, growth projections, team information, and historical performance, so that I can make informed investment decisions.

- As an Investor, I want to see business profiles presented in a standardized format across all businesses, so that I can easily compare different investment opportunities.

- As a Business Owner, I want to create a detailed business profile that showcases my company’s financial data, growth projections, team information, and historical performance, so that I can attract potential investors.

- As a System Administrator, I want to implement a standardized template for business profiles, so that all businesses present their information consistently on the platform.

- As a Guest, I want to view comprehensive business profiles without authentication, so that I can evaluate potential investment opportunities before registering.

- As an Investor, I want to access historical performance data of businesses, so that I can assess their track record and potential for future growth.

- As a Business Owner, I want to update my business profile with real-time financial data and performance metrics, so that investors have access to the most current information.

- As an Investor, I want to see a summary of key financial indicators for each business profile, so that I can quickly assess its financial health.

- As a System Administrator, I want to ensure that all sensitive financial data in business profiles is encrypted at rest, so that we comply with data protection regulations and maintain user trust.

- As an Investor, I want business profiles to load within 2 seconds, so that I can efficiently review multiple investment opportunities without delays.

- User Stories

- Investment Transaction Processing

The Investment Transaction Processing module is designed to facilitate a secure, efficient, and user-friendly investment transaction experience for investors on the crowdfunding platform. The module will guide investors through a step-by-step process where they can specify their investment amount, review detailed terms and conditions, and complete the transaction. To ensure legal compliance, the module will integrate an e-signature functionality allowing investors to electronically sign necessary legal documents within the platform. A secure payment gateway will be implemented to handle fund transfers, ensuring that all financial transactions are encrypted and protected against unauthorized access. The system will provide real-time updates on the status of investment transactions, allowing investors to track progress from initiation to completion. Additionally, businesses will be able to review and accept investor commitments, while receiving notifications when a transaction is initiated. System administrators will have tools to monitor transactions in real-time and generate comprehensive audit trails for compliance purposes. The module will ensure that all transaction data is securely stored and traceable, thus maintaining the integrity and security of the investment process.- User Stories

- As an Investor, I want to initiate an investment transaction through a guided step-by-step process so that I can easily specify my investment amount and review terms.

- As an Investor, I want to electronically sign legal documents within the platform so that I can complete the investment process efficiently and in compliance with regulations.

- As an Investor, I want to transfer funds through a secure payment gateway so that I can finalize my investment with confidence in the transaction’s security.

- As an Investor, I want to receive real-time updates on the status of my investment transaction so that I can track its progress from initiation to completion.

- As a Business Owner, I want to review and accept investor commitments through the platform so that I can manage my fundraising campaign effectively.

- As a System Administrator, I want to monitor all investment transactions in real-time so that I can ensure the integrity and security of the process.

- As a System Administrator, I want to generate transaction records for all investments so that I can maintain a comprehensive audit trail for compliance purposes.

- As an Investor, I want the platform to encrypt all my financial transaction data so that my sensitive information remains secure throughout the investment process.

- As a Business Owner, I want to receive notifications when an investor initiates a transaction for my campaign so that I can promptly review and respond to investment offers.

- As an Investor, I want the investment transaction to be processed within 5 seconds from initiation to confirmation so that I can efficiently complete my investment decisions.

- User Stories

- Investment Portfolio Dashboard

The Investment Portfolio Dashboard will present investors with an intuitive and interactive interface, offering a comprehensive overview of their investments. The dashboard will feature a summary section displaying the total invested amount, number of active investments, and overall portfolio performance metrics. Investors will access various charts and graphs illustrating portfolio diversity and performance trends over time, facilitating a clear understanding of investment spread and returns. The dashboard will enable detailed drill-down into individual investments, showing specific data points such as investment dates, asset types, and performance indicators. For security, all portfolio data will be encrypted both in transit and at rest, adhering to industry standards. The dashboard will comply with the Securities Act of 1933, ensuring all displayed information is accurate and complete. The user interface will be optimized for a seamless user experience, ensuring the dashboard loads within 3 seconds, even under high data loads. The system will integrate with AI-based tools to offer personalized investment recommendations, enhancing user decision-making capabilities. The platform will maintain legal compliance by incorporating e-signature capabilities and a robust verification process to authenticate user identities and transactions.- User Stories

- As an Investor, I want to view a comprehensive dashboard of my investment portfolio so that I can quickly assess my overall investment performance.

- As an Investor, I want to see the total invested amount across all my investments so that I can track my total capital allocation.

- As an Investor, I want to view the number of active investments in my portfolio so that I can understand my level of diversification.

- As an Investor, I want to see visual representations of my portfolio diversity through charts and graphs so that I can easily comprehend my investment spread.

- As an Investor, I want to view my portfolio’s returns over time in a graphical format so that I can analyze performance trends.

- As an Investor, I want to drill down into detailed information on individual investments from my dashboard so that I can examine specific investment performance.

- As an Investor, I want my portfolio dashboard to load within 3 seconds so that I can quickly access my investment information.

- As an Investor, I want my portfolio data to be encrypted at rest so that my sensitive financial information remains secure.

- As a System Administrator, I want to ensure that the portfolio dashboard complies with the Securities Act of 1933 disclosure requirements so that investors receive accurate and comprehensive information.

- User Stories

- AI-Powered Investment Recommendations

The AI-Powered Investment Recommendations module is designed to integrate an advanced AI-driven recommendation engine into the crowdfunding platform. This engine analyzes investors’ profiles, past investment behaviors, stated preferences, risk tolerance, industry preferences, and investment amounts to generate personalized investment suggestions. The module must leverage machine learning algorithms to identify patterns and trends in investment data, ensuring that recommendations are relevant and timely. It should also incorporate data validation and transformation processes to accurately interpret investor data inputs. The system should present these recommendations through a user-friendly interface, allowing investors to easily comprehend the key reasons behind each suggestion. Additionally, the module must include mechanisms for regular updates based on new data and market trends, ensuring that recommendations remain current. Compliance with relevant securities regulations and transparency in data usage are critical considerations, ensuring investor trust and legal adherence. This comprehensive approach will enable investors to discover potential opportunities aligned with their investment strategies, while also increasing the visibility of business campaigns to relevant investors.- User Stories

- As an Investor, I want to receive AI-powered investment recommendations based on my profile and preferences so that I can discover potential opportunities aligned with my investment strategy.

- As an Investor, I want the AI recommendation engine to consider my past investment behavior and risk tolerance so that the suggested opportunities are tailored to my specific needs.

- As an Investor, I want to view AI-suggested investment opportunities in an easily digestible format so that I can quickly assess their potential.

- As an Investor, I want to see key reasons for each AI-recommended investment suggestion so that I can understand the rationale behind the recommendations.

- As a Business Owner, I want my campaign to be included in AI-powered recommendations to relevant investors so that I can increase my chances of successful fundraising.

- As an Investor, I want the AI recommendations to be updated regularly based on new data and market trends so that I always have access to current investment opportunities.

- As a System Administrator, I want to ensure that the AI recommendation engine complies with relevant securities regulations so that we maintain legal compliance in our investment suggestions.

- As an Investor, I want the AI recommendation process to be transparent about data usage so that I can trust the integrity of the suggestions provided.

- User Stories

My Profile

Description

This module allows users to manage their personal profiles, view their investment history, track their investment performance, and access their account settings. Users can also view their investment portfolio and manage their personal information. This module will contain a dashboard where users can view their personal information, their investment history, and their account settings. It will also include sub-modules for managing personal information and accessing account settings. Additionally, this module will allow users to see their businesses, corresponding roles and campaigns.

Functional Design

- User Profile Management

The User Profile Management module is designed to facilitate comprehensive management of user profiles for both business owners and investors. It aims to deliver a user-friendly interface allowing users to create, view, edit, and delete their personal information securely. The module will include fields for essential contact information, investment preferences, and business details where applicable. Each profile will be equipped with a robust verification process to ensure authenticity and reliability, aligning with the platform’s credibility goals. The module will enable business owners to add and modify their business details, showcasing their company effectively to potential investors. Investors, on the other hand, will be able to set and update their investment preferences, aiding in receiving tailored investment recommendations. The system will ensure user data security through encryption and compliance with relevant data protection standards. Additionally, it will provide users with the capability to view their investment history and performance, enhancing their experience and engagement on the platform. All actions within the module will be designed to be intuitive, ensuring easy access and modification of profile settings, thus enabling efficient account management. The design will consider scalability for future enhancements and integration with other platform features, such as AI-based investment recommendations, to support informed decision-making. Overall, the module will serve as a critical component in establishing a secure, reliable, and user-centric environment, fostering trust and engagement between Kansas-based businesses and investors.- User Stories

- As a Business Owner, I want to create and edit my personal profile so that I can provide accurate and up-to-date information about myself and my business.

- As an Investor, I want to view and update my personal information so that I can maintain an accurate profile for potential investment opportunities.

- As a Business Owner, I want to add and modify my business details within my profile so that I can showcase my company’s information to potential investors.

- As an Investor, I want to set and update my investment preferences so that I can receive relevant recommendations and opportunities.

- As a System Administrator, I want to manage user profiles efficiently so that I can ensure the accuracy and completeness of user information across the platform.

- As a Business Owner or Investor, I want to delete my profile if necessary so that I can remove my information from the platform when I no longer wish to participate.

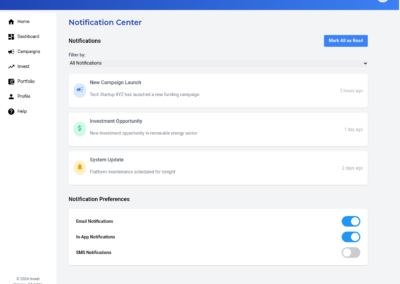

- As a User, I want my profile information to be securely stored so that I can trust the platform with my personal and financial data.